文章目录

- LSTM 时间序列预测

- 股票预测案例

- 数据特征

- 对收盘价(Close)单特征进行预测

- 1. 导入数据

- 2. 将股票数据收盘价(Close)进行可视化展示

- 3. 特征工程

- 4. 数据集制作

- 5. 模型构建

- 6. 模型训练

- 7. 模型结果可视化

- 8. 模型验证

- 完整代码

LSTM 时间序列预测

股票预测案例

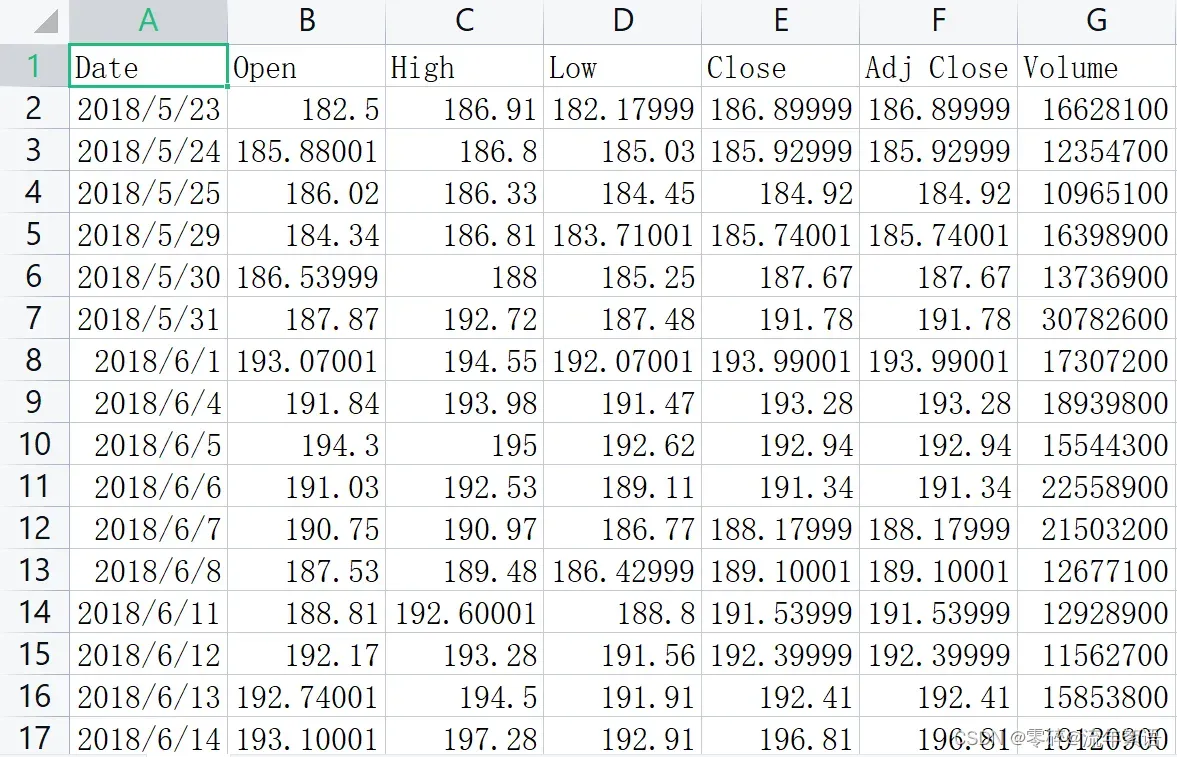

数据特征

- Date:日期

- Open:开盘价

- High:最高价

- Low:最低价

- Close:收盘价

- Adj Close:调整后的收盘价

- Volume:交易量

对收盘价(Close)单特征进行预测

利用前n天的数据预测第n+1天的数据。

1. 导入数据

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.preprocessing import MinMaxScaler

filepath = 'D:/pythonProjects/LSTM/data/rlData.csv'

data = pd.read_csv(filepath)

# 将数据按照日期进行排序,确保时间序列递增

data = data.sort_values('Date')

# 打印前几条数据

print(data.head())

# 打印维度

print(data.shape)

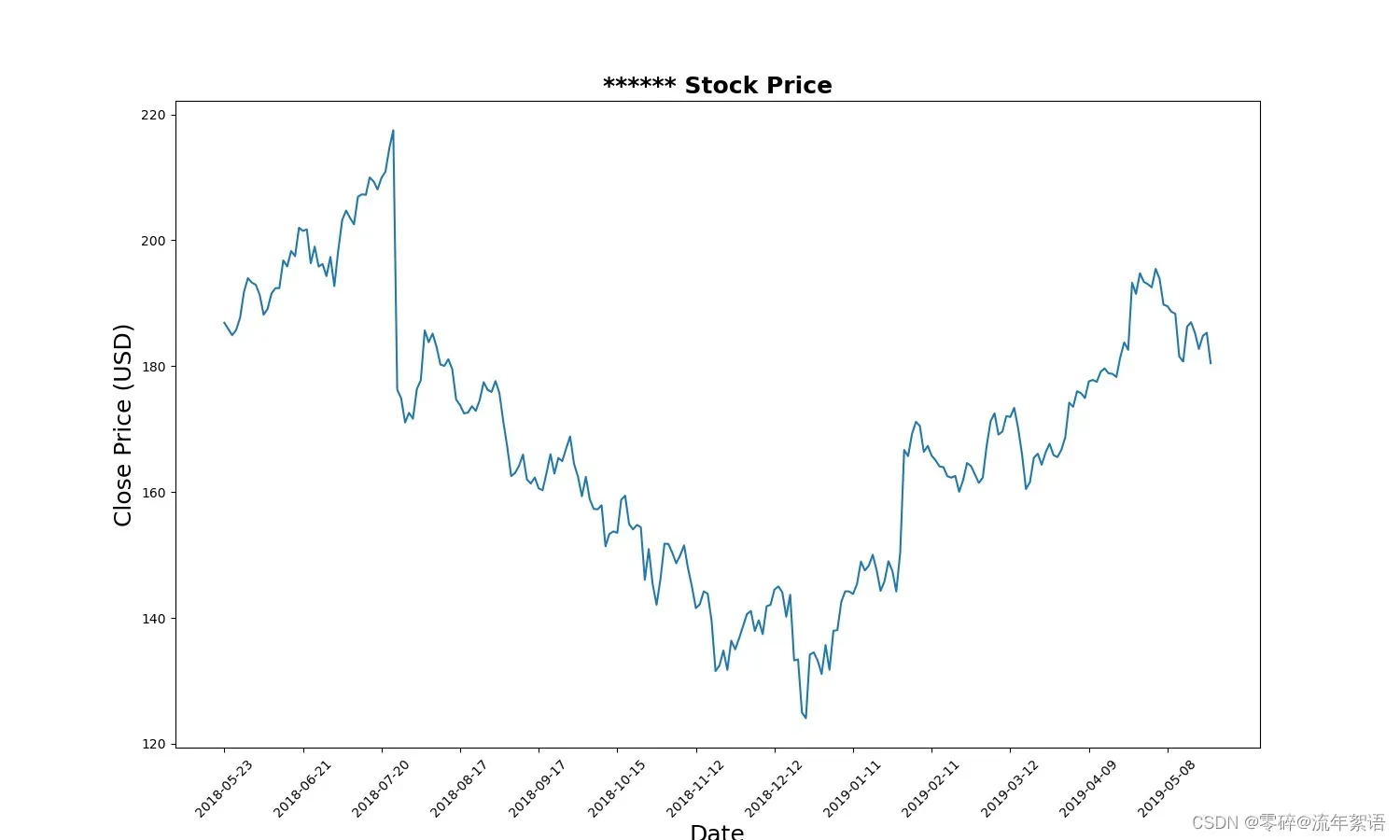

2. 将股票数据收盘价(Close)进行可视化展示

# 设置画布大小

plt.figure(figsize=(15, 9))

plt.plot(data[['Close']])

plt.xticks(range(0, data.shape[0], 20), data['Date'].loc[::20], rotation=45)

plt.title("****** Stock Price", fontsize=18, fontweight='bold')

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price (USD)', fontsize=18)

plt.savefig('StockPrice.jpg')

plt.show()

3. 特征工程

# 选取Close作为特征

price = data[['Close']]

# 打印相关信息

print(price.info())

打印结果如下:

<class 'pandas.core.frame.DataFrame'>

Int64Index: 252 entries, 0 to 251

Data columns (total 1 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 Close 252 non-null float64

dtypes: float64(1)

memory usage: 3.9 KB

None

可以看出:price为DataFrame对象,以及其的结构和占用内存等信息

# 进行不同的数据缩放,将数据缩放到-1和1之间,归一化操作

scaler = MinMaxScaler(feature_range=(-1, 1))

price['Close'] = scaler.fit_transform(price['Close'].values.reshape(-1, 1))

print(price['Close'].shape)

打印结果如下:

0 0.345034

1 0.324272

2 0.302654

3 0.320206

4 0.361515

...

247 0.310788

248 0.255565

249 0.300514

250 0.311216

251 0.207192

Name: Close, Length: 252, dtype: float64

<class 'pandas.core.series.Series'>

Int64Index: 252 entries, 0 to 251

Series name: Close

Non-Null Count Dtype

-------------- -----

252 non-null float64

dtypes: float64(1)

memory usage: 3.9 KB

None

(252,)

可以看出:price['Close']的值,price['Close']为Series结构,price['Close']的结构为(252,)

4. 数据集制作

# 今天的收盘价预测明天的收盘价

# lookback表示观察的跨度

def split_data(stock, lookback):

# 将stock转化为ndarray类型

data_raw = stock.to_numpy()

data = []

# you can free play(seq_length)

# 将data按lookback分组,data为长度为lookback的list

for index in range(len(data_raw) - lookback):

data.append(data_raw[index: index + lookback])

data = np.array(data);

print(type(data)) # (232, 20, 1)

# 按照8:2进行训练集、测试集划分

test_set_size = int(np.round(0.2 * data.shape[0]))

train_set_size = data.shape[0] - (test_set_size)

x_train = data[:train_set_size, :-1, :]

y_train = data[:train_set_size, -1, :]

x_test = data[train_set_size:, :-1]

y_test = data[train_set_size:, -1, :]

return [x_train, y_train, x_test, y_test]

lookback = 20

x_train, y_train, x_test, y_test = split_data(price, lookback)

print('x_train.shape = ', x_train.shape)

print('y_train.shape = ', y_train.shape)

print('x_test.shape = ', x_test.shape)

print('y_test.shape = ', y_test.shape)

打印结果如下:

x_train.shape = (186, 19, 1)

y_train.shape = (186, 1)

x_test.shape = (46, 19, 1)

y_test.shape = (46, 1)

5. 模型构建

import torch

import torch.nn as nn

x_train = torch.from_numpy(x_train).type(torch.Tensor)

x_test = torch.from_numpy(x_test).type(torch.Tensor)

# 真实的数据

y_train_lstm = torch.from_numpy(y_train).type(torch.Tensor)

y_test_lstm = torch.from_numpy(y_test).type(torch.Tensor)

y_train_gru = torch.from_numpy(y_train).type(torch.Tensor)

y_test_gru = torch.from_numpy(y_test).type(torch.Tensor)

# 输入的维度为1,只有Close收盘价

input_dim = 1

# 隐藏层特征的维度

hidden_dim = 32

# 循环的layers

num_layers = 2

# 预测后一天的收盘价

output_dim = 1

num_epochs = 100

class LSTM(nn.Module):

def __init__(self, input_dim, hidden_dim, num_layers, output_dim):

super(LSTM, self).__init__()

self.hidden_dim = hidden_dim

self.num_layers = num_layers

self.lstm = nn.LSTM(input_dim, hidden_dim, num_layers, batch_first=True)

self.fc = nn.Linear(hidden_dim, output_dim)

def forward(self, x):

h0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_()

c0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_()

out, (hn, cn) = self.lstm(x, (h0.detach(), c0.detach()))

out = self.fc(out[:, -1, :])

return out

model = LSTM(input_dim=input_dim, hidden_dim=hidden_dim, output_dim=output_dim, num_layers=num_layers)

criterion = torch.nn.MSELoss()

optimiser = torch.optim.Adam(model.parameters(), lr=0.01)

6. 模型训练

import time

hist = np.zeros(num_epochs)

start_time = time.time()

lstm = []

for t in range(num_epochs):

y_train_pred = model(x_train)

loss = criterion(y_train_pred, y_train_lstm)

print("Epoch ", t, "MSE: ", loss.item())

hist[t] = loss.item()

optimiser.zero_grad()

loss.backward()

optimiser.step()

training_time = time.time() - start_time

print("Training time: {}".format(training_time))

predict = pd.DataFrame(scaler.inverse_transform(y_train_pred.detach().numpy()))

print(predict) # 预测值

original = pd.DataFrame(scaler.inverse_transform(y_train_lstm.detach().numpy()))

print(original) # 真实值

打印结果如下:其中预测值每次运行可能会有一定的差距,但不影响最后的结果。

torch.Size([186, 1])

Epoch 0 MSE: 0.19840142130851746

torch.Size([186, 1])

Epoch 1 MSE: 0.17595666646957397

torch.Size([186, 1])

Epoch 2 MSE: 0.1369851976633072

torch.Size([186, 1])

.. ...

Epoch 96 MSE: 0.008701297454535961

torch.Size([186, 1])

Epoch 97 MSE: 0.008698086254298687

torch.Size([186, 1])

Epoch 98 MSE: 0.008688708767294884

torch.Size([186, 1])

Epoch 99 MSE: 0.008677813224494457

Training time: 3.884610414505005

0

0 196.654999

1 201.095291

2 200.198563

3 200.494003

4 195.120148

.. ...

181 171.398987

182 171.508194

183 172.992401

184 169.850494

185 165.566605

[186 rows x 1 columns]

0

0 201.999985

1 201.500015

2 201.740005

3 196.350006

4 198.999985

.. ...

181 171.919998

182 173.369995

183 170.169998

184 165.979996

185 160.470001

[186 rows x 1 columns]

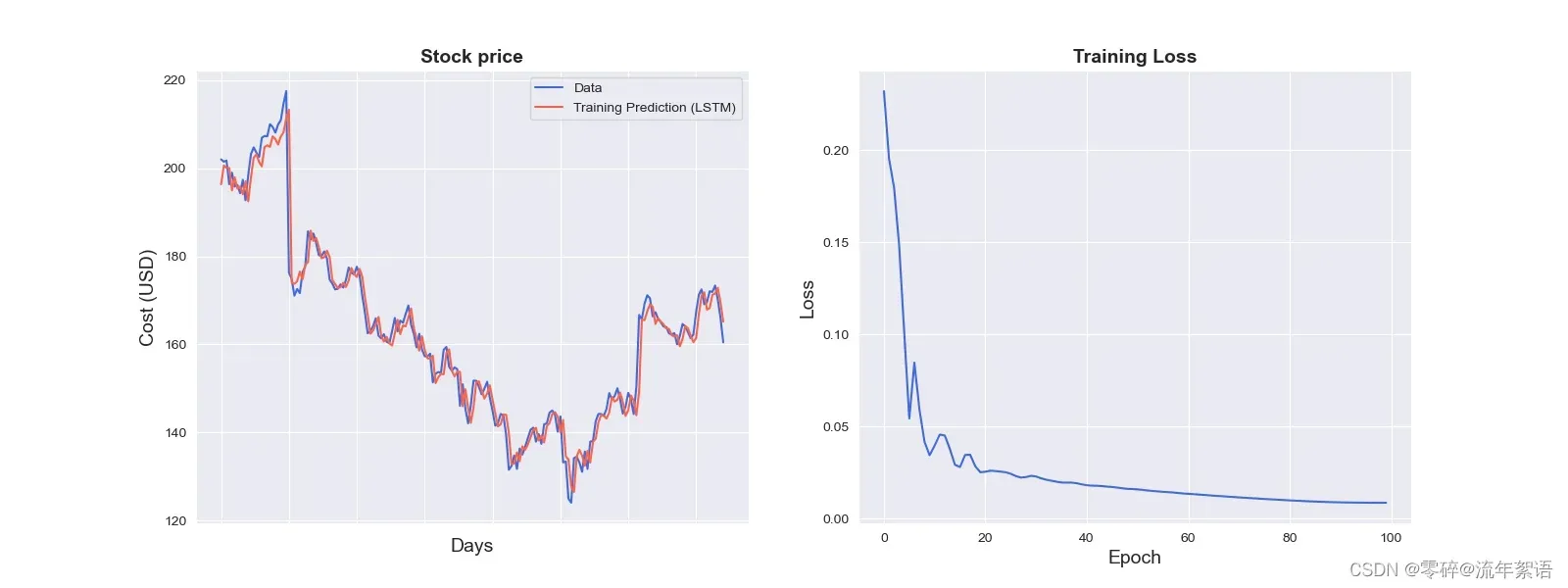

7. 模型结果可视化

import seaborn as sns

sns.set_style("darkgrid")

fig = plt.figure()

fig.subplots_adjust(hspace=0.2, wspace=0.2)

plt.subplot(1, 2, 1)

ax = sns.lineplot(x = original.index, y = original[0], label="Data", color='royalblue')

ax = sns.lineplot(x = predict.index, y = predict[0], label="Training Prediction (LSTM)", color='tomato')

print(predict.index)

print("aaaa")

print(predict[0])

ax.set_title('Stock price', size = 14, fontweight='bold')

ax.set_xlabel("Days", size = 14)

ax.set_ylabel("Cost (USD)", size = 14)

ax.set_xticklabels('', size=10)

plt.subplot(1, 2, 2)

ax = sns.lineplot(data=hist, color='royalblue')

ax.set_xlabel("Epoch", size = 14)

ax.set_ylabel("Loss", size = 14)

ax.set_title("Training Loss", size = 14, fontweight='bold')

fig.set_figheight(6)

fig.set_figwidth(16)

plt.show()

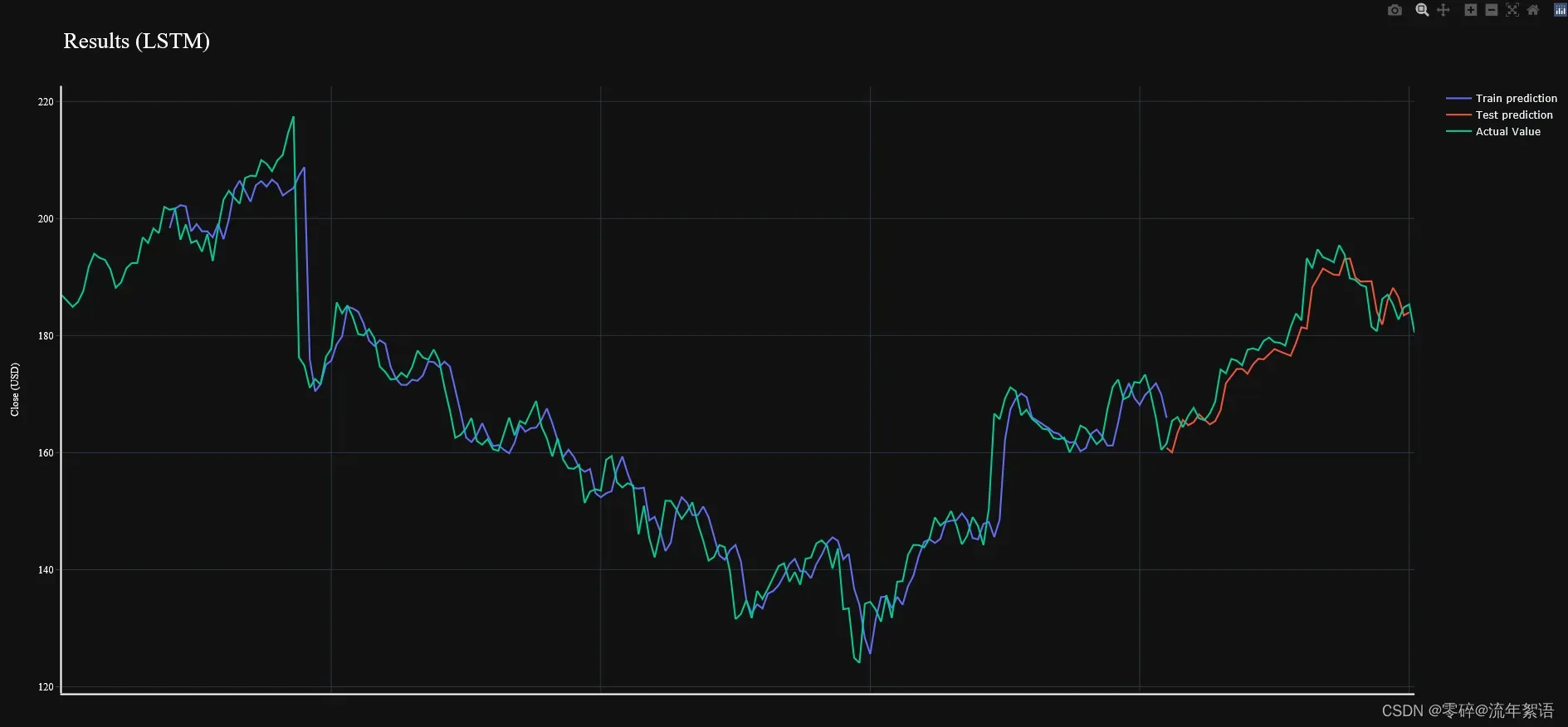

8. 模型验证

实际上是对结果的总结及进一步说明。

import math, time

from sklearn.metrics import mean_squared_error

# make predictions

y_test_pred = model(x_test)

# invert predictions

y_train_pred = scaler.inverse_transform(y_train_pred.detach().numpy())

y_train = scaler.inverse_transform(y_train_lstm.detach().numpy())

y_test_pred = scaler.inverse_transform(y_test_pred.detach().numpy())

y_test = scaler.inverse_transform(y_test_lstm.detach().numpy())

# calculate root mean squared error

trainScore = math.sqrt(mean_squared_error(y_train[:,0], y_train_pred[:,0]))

print('Train Score: %.2f RMSE' % (trainScore))

testScore = math.sqrt(mean_squared_error(y_test[:,0], y_test_pred[:,0]))

print('Test Score: %.2f RMSE' % (testScore))

lstm.append(trainScore)

lstm.append(testScore)

lstm.append(training_time)

# shift train predictions for plotting

trainPredictPlot = np.empty_like(price)

trainPredictPlot[:, :] = np.nan

trainPredictPlot[lookback:len(y_train_pred)+lookback, :] = y_train_pred

# shift test predictions for plotting

testPredictPlot = np.empty_like(price)

testPredictPlot[:, :] = np.nan

testPredictPlot[len(y_train_pred)+lookback-1:len(price)-1, :] = y_test_pred

original = scaler.inverse_transform(price['Close'].values.reshape(-1,1))

predictions = np.append(trainPredictPlot, testPredictPlot, axis=1)

predictions = np.append(predictions, original, axis=1)

result = pd.DataFrame(predictions)

import plotly.express as px

import plotly.graph_objects as go

fig = go.Figure()

fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[0],

mode='lines',

name='Train prediction')))

fig.add_trace(go.Scatter(x=result.index, y=result[1],

mode='lines',

name='Test prediction'))

fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[2],

mode='lines',

name='Actual Value')))

fig.update_layout(

xaxis=dict(

showline=True,

showgrid=True,

showticklabels=False,

linecolor='white',

linewidth=2

),

yaxis=dict(

title_text='Close (USD)',

titlefont=dict(

family='Rockwell',

size=12,

color='white',

),

showline=True,

showgrid=True,

showticklabels=True,

linecolor='white',

linewidth=2,

ticks='outside',

tickfont=dict(

family='Rockwell',

size=12,

color='white',

),

),

showlegend=True,

template = 'plotly_dark'

)

annotations = []

annotations.append(dict(xref='paper', yref='paper', x=0.0, y=1.05,

xanchor='left', yanchor='bottom',

text='Results (LSTM)',

font=dict(family='Rockwell',

size=26,

color='white'),

showarrow=False))

fig.update_layout(annotations=annotations)

fig.show()

完整代码

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

import seaborn as sns

filepath = 'D:/pythonProjects/LSTM/data/rlData.csv'

data = pd.read_csv(filepath)

data = data.sort_values('Date')

print(data.head())

print(data.shape)

sns.set_style("darkgrid")

plt.figure(figsize=(15, 9))

plt.plot(data[['Close']])

plt.xticks(range(0, data.shape[0], 20), data['Date'].loc[::20], rotation=45)

plt.title("****** Stock Price", fontsize=18, fontweight='bold')

plt.xlabel('Date', fontsize=18)

plt.ylabel('Close Price (USD)', fontsize=18)

plt.show()

# 1.特征工程

# 选取Close作为特征

price = data[['Close']]

print(price.info())

from sklearn.preprocessing import MinMaxScaler

# 进行不同的数据缩放,将数据缩放到-1和1之间

scaler = MinMaxScaler(feature_range=(-1, 1))

price['Close'] = scaler.fit_transform(price['Close'].values.reshape(-1, 1))

print(price['Close'].shape)

# 2.数据集制作

# 今天的收盘价预测明天的收盘价

# lookback表示观察的跨度

def split_data(stock, lookback):

data_raw = stock.to_numpy()

data = []

# print(data)

# you can free play(seq_length)

for index in range(len(data_raw) - lookback):

data.append(data_raw[index: index + lookback])

data = np.array(data);

test_set_size = int(np.round(0.2 * data.shape[0]))

train_set_size = data.shape[0] - (test_set_size)

x_train = data[:train_set_size, :-1, :]

y_train = data[:train_set_size, -1, :]

x_test = data[train_set_size:, :-1]

y_test = data[train_set_size:, -1, :]

return [x_train, y_train, x_test, y_test]

lookback = 20

x_train, y_train, x_test, y_test = split_data(price, lookback)

print('x_train.shape = ', x_train.shape)

print('y_train.shape = ', y_train.shape)

print('x_test.shape = ', x_test.shape)

print('y_test.shape = ', y_test.shape)

# 注意:pytorch的nn.LSTM input shape=(seq_length, batch_size, input_size)

# 3.模型构建 —— LSTM

import torch

import torch.nn as nn

x_train = torch.from_numpy(x_train).type(torch.Tensor)

x_test = torch.from_numpy(x_test).type(torch.Tensor)

y_train_lstm = torch.from_numpy(y_train).type(torch.Tensor)

y_test_lstm = torch.from_numpy(y_test).type(torch.Tensor)

y_train_gru = torch.from_numpy(y_train).type(torch.Tensor)

y_test_gru = torch.from_numpy(y_test).type(torch.Tensor)

# 输入的维度为1,只有Close收盘价

input_dim = 1

# 隐藏层特征的维度

hidden_dim = 32

# 循环的layers

num_layers = 2

# 预测后一天的收盘价

output_dim = 1

num_epochs = 100

class LSTM(nn.Module):

def __init__(self, input_dim, hidden_dim, num_layers, output_dim):

super(LSTM, self).__init__()

self.hidden_dim = hidden_dim

self.num_layers = num_layers

self.lstm = nn.LSTM(input_dim, hidden_dim, num_layers, batch_first=True)

self.fc = nn.Linear(hidden_dim, output_dim)

def forward(self, x):

h0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_()

c0 = torch.zeros(self.num_layers, x.size(0), self.hidden_dim).requires_grad_()

out, (hn, cn) = self.lstm(x, (h0.detach(), c0.detach()))

out = self.fc(out[:, -1, :])

return out

model = LSTM(input_dim=input_dim, hidden_dim=hidden_dim, output_dim=output_dim, num_layers=num_layers)

criterion = torch.nn.MSELoss()

optimiser = torch.optim.Adam(model.parameters(), lr=0.01)

# 4.模型训练

import time

hist = np.zeros(num_epochs)

start_time = time.time()

lstm = []

for t in range(num_epochs):

y_train_pred = model(x_train)

loss = criterion(y_train_pred, y_train_lstm)

print("Epoch ", t, "MSE: ", loss.item())

hist[t] = loss.item()

optimiser.zero_grad()

loss.backward()

optimiser.step()

training_time = time.time() - start_time

print("Training time: {}".format(training_time))

# 5.模型结果可视化

predict = pd.DataFrame(scaler.inverse_transform(y_train_pred.detach().numpy()))

original = pd.DataFrame(scaler.inverse_transform(y_train_lstm.detach().numpy()))

import seaborn as sns

sns.set_style("darkgrid")

fig = plt.figure()

fig.subplots_adjust(hspace=0.2, wspace=0.2)

plt.subplot(1, 2, 1)

ax = sns.lineplot(x = original.index, y = original[0], label="Data", color='royalblue')

ax = sns.lineplot(x = predict.index, y = predict[0], label="Training Prediction (LSTM)", color='tomato')

# print(predict.index)

# print(predict[0])

ax.set_title('Stock price', size = 14, fontweight='bold')

ax.set_xlabel("Days", size = 14)

ax.set_ylabel("Cost (USD)", size = 14)

ax.set_xticklabels('', size=10)

plt.subplot(1, 2, 2)

ax = sns.lineplot(data=hist, color='royalblue')

ax.set_xlabel("Epoch", size = 14)

ax.set_ylabel("Loss", size = 14)

ax.set_title("Training Loss", size = 14, fontweight='bold')

fig.set_figheight(6)

fig.set_figwidth(16)

plt.show()

# 6.模型验证

# print(x_test[-1])

import math, time

from sklearn.metrics import mean_squared_error

# make predictions

y_test_pred = model(x_test)

# invert predictions

y_train_pred = scaler.inverse_transform(y_train_pred.detach().numpy())

y_train = scaler.inverse_transform(y_train_lstm.detach().numpy())

y_test_pred = scaler.inverse_transform(y_test_pred.detach().numpy())

y_test = scaler.inverse_transform(y_test_lstm.detach().numpy())

# calculate root mean squared error

trainScore = math.sqrt(mean_squared_error(y_train[:,0], y_train_pred[:,0]))

print('Train Score: %.2f RMSE' % (trainScore))

testScore = math.sqrt(mean_squared_error(y_test[:,0], y_test_pred[:,0]))

print('Test Score: %.2f RMSE' % (testScore))

lstm.append(trainScore)

lstm.append(testScore)

lstm.append(training_time)

# In[40]:

# shift train predictions for plotting

trainPredictPlot = np.empty_like(price)

trainPredictPlot[:, :] = np.nan

trainPredictPlot[lookback:len(y_train_pred)+lookback, :] = y_train_pred

# shift test predictions for plotting

testPredictPlot = np.empty_like(price)

testPredictPlot[:, :] = np.nan

testPredictPlot[len(y_train_pred)+lookback-1:len(price)-1, :] = y_test_pred

original = scaler.inverse_transform(price['Close'].values.reshape(-1,1))

predictions = np.append(trainPredictPlot, testPredictPlot, axis=1)

predictions = np.append(predictions, original, axis=1)

result = pd.DataFrame(predictions)

import plotly.express as px

import plotly.graph_objects as go

fig = go.Figure()

fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[0],

mode='lines',

name='Train prediction')))

fig.add_trace(go.Scatter(x=result.index, y=result[1],

mode='lines',

name='Test prediction'))

fig.add_trace(go.Scatter(go.Scatter(x=result.index, y=result[2],

mode='lines',

name='Actual Value')))

fig.update_layout(

xaxis=dict(

showline=True,

showgrid=True,

showticklabels=False,

linecolor='white',

linewidth=2

),

yaxis=dict(

title_text='Close (USD)',

titlefont=dict(

family='Rockwell',

size=12,

color='white',

),

showline=True,

showgrid=True,

showticklabels=True,

linecolor='white',

linewidth=2,

ticks='outside',

tickfont=dict(

family='Rockwell',

size=12,

color='white',

),

),

showlegend=True,

template = 'plotly_dark'

)

annotations = []

annotations.append(dict(xref='paper', yref='paper', x=0.0, y=1.05,

xanchor='left', yanchor='bottom',

text='Results (LSTM)',

font=dict(family='Rockwell',

size=26,

color='white'),

showarrow=False))

fig.update_layout(annotations=annotations)

fig.show()

文章出处登录后可见!

已经登录?立即刷新